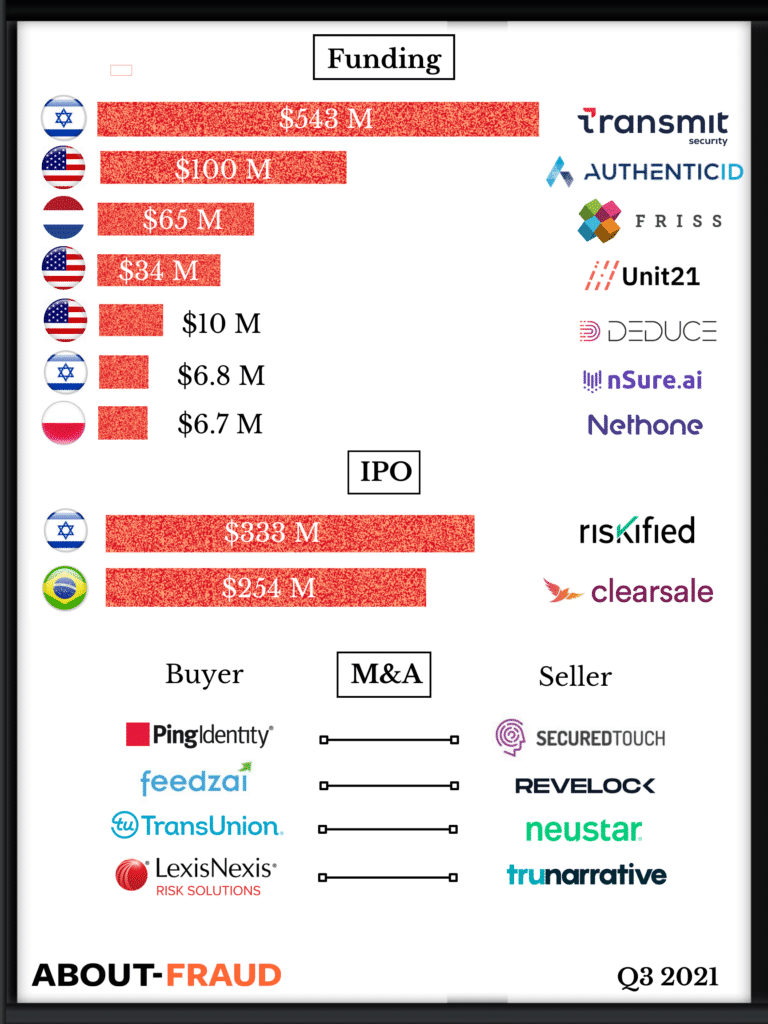

Investment, Acquisitions & IPO’s – Q3 2021

A little over 3 months ago, we wrote an article detailing the big investment and acquisitions in the fraud prevention space for the first half of 2021. Since then, there were so many more we needed a refresh! This is highlighted by Transmit Security raising an eye-popping $543 million in series A funding. Have a read to learn the latest funding and acquisition developments in the fraud prevention industry.

LexisNexis acquired TruNarrative, a company based in Leeds in a deal reported at £130 million.

TruNarrative creates a unified platform where organisations can manage the entire financial crime lifecycle. Through an API this platform allows for no-code configuration and rapid integration enabling a single view of customer risk. Their technology has been used by leading global brands such as Playtech, Holland Casino and Ikano Bank.

LexisNexis have a wide range of services focusing primarily on enabling organizations to improve analysis and risk assessment. The CEO of LexisNexis Risk Solutions, Rick Trainor commented on the acquisition, “ The TruNarrative platform aligns with our financial crime compliance and fraud solutions”.

Unit 21

Unit21 raised $34 million in Series B funding. Former Affirm product manager Trisha Kothari and Clarence Chio founded Unit21 in 2018 with the goal of giving risk, compliance and fraud teams a way to fight financial crime via a “secure, integrated, no-code platform.”

Unit21 describes its core technology as a “flag-and-review” toolset designed to give non-technical operators and anti-money laundering (AML) teams the ability to “easily” write complex statistical models and deploy customized workflows without having to involve their engineering teams.

FRISS

FRISS raised an impressive $65 million in a series b investment, led by Accel-KKR and endorsed by existing investor Aquiline this year. FRISS provides AI-powered fraud prevention and detection solutions for insurance companies worldwide. The funding will enable the expansion of the company and the creation of new product innovations.

AuthenticID

In another funding story this year, AuthenticID raised $100 million from Long Ridge Equity Partners.

AuthenticID provides document-centric identity verification focusing on the US wireless carrier market. “Our platform is relied upon by the majority of the US wireless carriers and various identity platforms to establish identity”.

With this recent investment, AuthenticID plans to expand into telecommunications, financial services, government and other consumer segments.

Riskified

Israeli company Riskified planned to raise $333 million when they issued their IPO a couple months ago.

Riskified has created an e-commerce platform which allows online customers to create trusted relationships with consumers. It’s main focus is enterprise merchants which include companies such as Macy’s, Wayfair and Booking.com.

Deduce

Deduce, a New York based start-up raised $10 million in a Series A investment, making it’s overall funding raised over $17 million.

This round of funding is focused on the launch of a new product, Deduce Insights, a platform which will act as a cybersecurity radar to catch fraudulent behaviour early.

Account takeover has become one of the most popular ways to commit fraud during the pandemic. Statistics show that the rate of fraudulent logins from Q2 2019 to Q2 2020 has increased by 282%. The Deduce platform is attempting to tackle this problem by providing a real-time, AI driven radar which can detect whether a user is who they claim to be.

Nethone

Nethone, a Polish based Fraud company raised $6.7 million in funding. Nethone specializes in cyber-security with a focus on preventing fraud in remote channels, e.g. payments with credit and debit cards or when it is related to identity or account takeover.

SecuredTouch

In an acquisition story, Ping Identity, a US based enterprise identity solution provider, has announced that it bought SecuredTouch, an Israeli based fraud and bot detection company.

Feedzai

Feedzai made news headlines for acquiring Revelock after a $200 million investment round.

The acquired company Revelock is a digital identity solution provider which combines behavioral biometrics, device assessment, phishing and endpoint malware detection into a unified package.

The acquisition of Revelcock furthers this mission as the behavioral and device data the Revelock platform provides allows companies to trust their customers more in this increasingly digitized world.

Transmit Security

In a funding round which is being dubbed the largest in cybersecurity history, Transmit Security with a mission statement to “rid the world of passwords”, has raised $543 million in Series A funding. This brings the company’s pre-money valuation to $2.2 billion.

Transmit Security plans to use this funding to expand its business and continue it’s purpose of helping the world go passwordless.

nSure.ai

nSure.ai raises $6.8 million in funding to develop AI fraud prevention for digital goods.

Alex Zeltcer and Ziv Isaiah founded the company to offer a solution which protects sellers of digital goods against fraudsters.

TransUnion

Transunion acquired Neustar, a digital identity solution, for $3.1 billion.

TransUnion expects Neustar’s OneID platform to help unify the digital identity capability TransUnion has built and acquired in recent years, including the TLO data assets and fusion platform, and the Iovation device-reputation network.

ClearSale

ClearSale’s IPO Raised $254 million as they eye further growth and innovation.

ClearSale’s advanced statistical technology and its team of expert fraud analysts—the world’s largest—combine to offer unique card-not-present (CNP) fraud prevention that reduces chargebacks and false positives while helping merchants to deliver an excellent customer experience.

A Look Ahead

The large funding and acquisitions signals both sector growth and consolidation. As the fraud world has become increasingly digitized, a significant theme this year has been the importance of AI and major funding has gone to companies focusing on new technology to tackle fraud.

As the economy stabilizes and the world is moving towards digital solutions, the importance of anti-fraud becomes more prevalent.

| Tagged with: |

| Posted in: | Uncategorized |