14

Days

08

Hours

18

Minutes

35

Seconds

Join our

next Webinar.

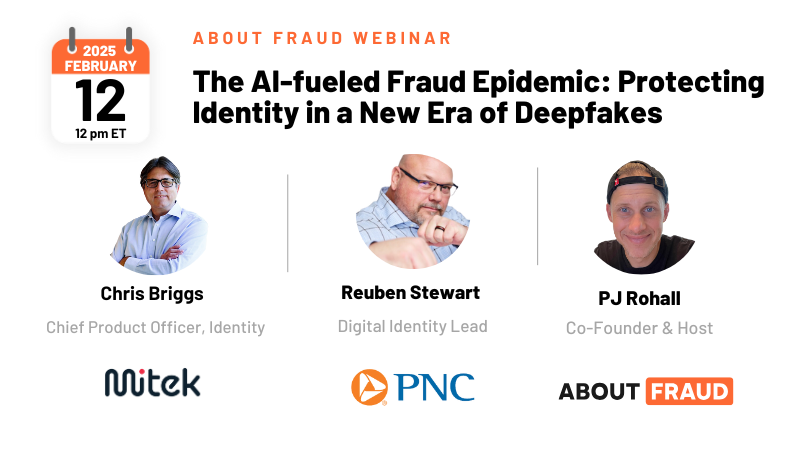

ID fraud has evolved dramatically in 2025. Stolen IDs and genAI fakes are nothing new; fraudsters have found ways to steal real faces, giving them a higher chance of passing high-assurance checks.

This webinar will cover how businesses can use a more strategic approach to signals.