Beyond KYC: Know Your Business & UBO

Knowing your customer and the ultimate beneficial owners (UBO), who own and control a business, is fundamental to satisfying regulatory requirements as well as understanding risk, explains Christian Chmiel, Chief Innovation Officer, Web Shield.

Identifying and verifying customer identities is central to customer due diligence. This is the process by which a firm assesses the customer’s level of risk according to its own risk-based approach. It’s also a legal requirement for regulated firms to prevent the financial system being used to launder money or finance terrorism.

The modernisation of AML and introduction of a principles-based approach has broadened the remit of customer due diligence. It’s gone from simple know your customer (KYC) to know your business (KYB), and even know your customer’s customers.

This is especially relevant for card acquirers who contract with independent sales organizations (ISOs) or payment facilitators to sign up merchants on their behalf. There are also fourth-party relationships, a third party of an acquirer’s third party.

Who’s behind a business?

To obtain a complete picture of the risk associated with a business relationship, regulated entities must clarify who’s behind a business. And then verify these identities using reliable, independent source documents, data or information.

What’s more, they must understand the purpose and intended nature of the customer’s relationship with their firm. And collect information about the customer and beneficial owners where applicable.

These steps also help ascertain what’s normal for a customer, so unusual or out-of-pattern behaviour stands out more clearly. And informs ongoing customer due diligence and monitoring.

So, while performing adequate customer due diligence is a regulatory requirement from an anti-money laundering (AML) and countering the financing of terrorism (CFT) point-of-view, it’s also good business practice generally for understanding and pricing risk.

When it comes to card acquiring, acquirers guarantee their merchant’s card sales at the time of purchase and into the future. If merchants are selling goods and then failing to deliver them, providing goods not as described, processing sales more than once, failing to seek authorisations and so on, then this opens acquirers up to possible chargebacks.

Too many chargebacks could mean card scheme fines and possible licence revocation in the worst-case scenario. There’s also the reputational damage if merchants have caused consumer disgruntlement, financial loss, or even death in the case of pharmaceutical sales. The antidote to all this is good due diligence, which brings us back to identity.

What is an ultimate beneficial owner (UBO)?

Regulated entities must identify a business’s ultimate beneficial owners or UBOs. These are the natural persons who ultimately own or control the company or merchant business, or the natural persons on whose behalf a transaction or activity is conducted. It also includes those who exercise ultimate effective control over a legal person or arrangement.

Beware of nominee directors. Just as addresses can be used for mass company registrations, company owners and directors may also be ‘mass nominees’, acting for a large number of companies. They can provide anonymity, conceal beneficial ownership and disguise the origin and audit trail of funds.

For example, a 2016 Reuters report revealed how a former steel town in the north-east of England, Consett, County Durham, was at the centre of a company formation ring. Around 400 people in the town were recruited as directors for more than 1,000 shell companies.

Sometimes unemployed and struggling to make ends meet, these local residents were small players in the company formation industry.

They served as directors of multiple companies, receiving £50 cash for a directorship and £150 a year to forward mail received at their addresses. A local businessman offered company formation services for £2,500-£3,000 per time, administrating 1,200 companies at his peak, Reuters found.

Although they had no real operations or staff in the UK, a UK address allowed the companies to open merchant accounts in Europe. These were frequently used to process card payments for high-risk merchant sectors, serving as fronts for online porn, gambling and dating websites, or those selling health products, frequently on negative option or with fake free trials.

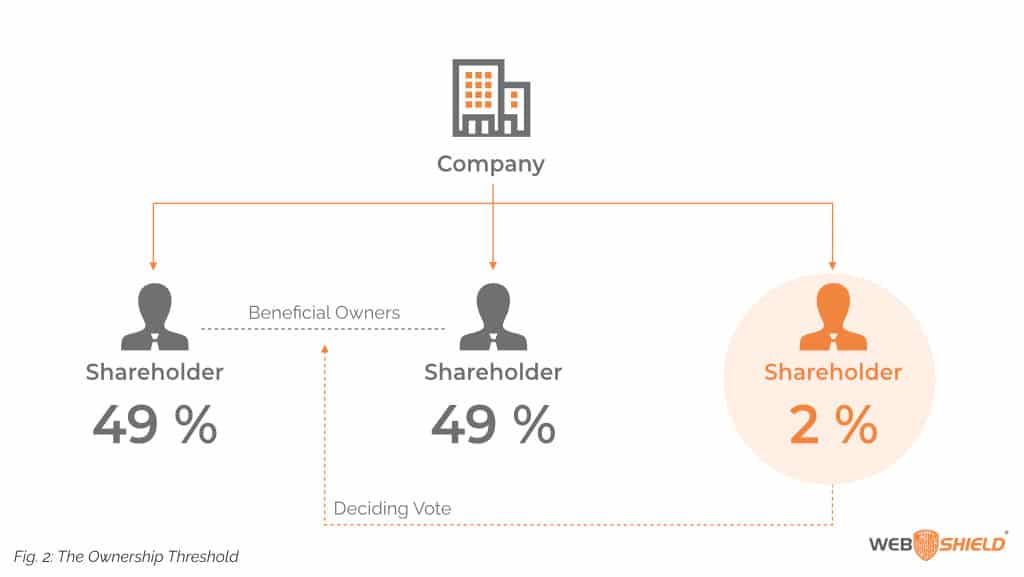

The ownership threshold

Unravelling corporate ownership structures can be complex. Companies can be owned by natural persons and/or legal entities, i.e. other companies or trusts ‘stacked’ on top of each other, where each company holds some or all of the shares in the one below it. These arrangements may also exist cross-border.

The Fourth European Anti-Money Laundering Directive defines a 25% ownership threshold for beneficial owners, although other jurisdictions may have different thresholds. Context is everything and UBOs with less than 25% ownership could still warrant a follow-up. The 25% shouldn’t be applied in an arbitrary way.

For example, a company may have three beneficial owners, two of whom own 49% of the shares and the third owns 2%. Because this third owner could join together with one of their co-owners in votes, they effectively have the casting vote. With a potentially influential role in decision-making disproportionate to their ownership, the identity and background of the third owner merits further investigation.

Regulated entities must identify and verify UBOs on an ongoing basis, recording their full names as a minimum. Additional information, such as date and place of birth, nationality and address may also be retained. Furthermore, it’s advisable to document corporate ownership and control structures, along with the reasons for any complex or opaque structures.

How Web Shield can help

Web Shield has added a new feature to its on-boarding platform to help make customer due diligence and record-keeping quicker, easier and more effective. UBOReveal retrieves all corporate documents from registries in 62 supported jurisdictions and counting that are necessary to identify UBOs. All findings concerning shareholders and UBOs as well as documents retrieved are compiled into a single pdf report for record-keeping and monitoring purposes.

As part of its ongoing commitment to educating risk professionals, Web Shield is now offering a range of new online courses in addition to our popular, in-person courses. Three of these new courses relate to anti-money laundering and are available for remote study.

| Tagged with: |

| Posted in: | AF Education |