Investment, Acquisitions & IPOs – Q1 2023

Q1 is wrapping up in a couple days, so it’s time for our quarterly investment update. Have a read to learn more about the relevant moves in the industry!

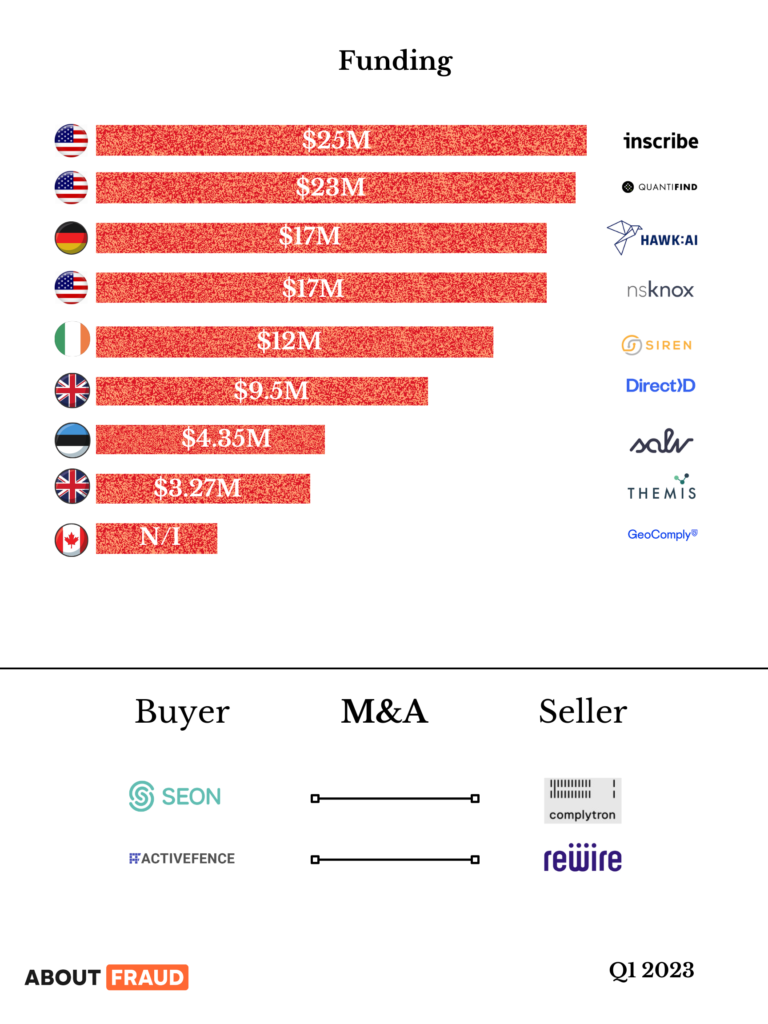

Funding

Inscribe

US-based Inscribe gets $25M to fight financial fraud with AI.

Asked about expansion plans, the founder says that Inscribe will likely double the size of its 50-person workforce over the next 12 to 18 months.

Quantifind

Quantifind, a provider of AI-powered financial crime risk management solutions, has raised $23 million in a funding round led by DNS Capital.

The round also saw participation from Citi Ventures, US Venture Partners, Valor Equity Partners, and S&P Global.

Hawk:AI

Prior to now, Hawk:AI had raised $10 million, and with a fresh $17 million in the bank, the company said that it plans to bolster its product development and global expansion plans. The Series B round was led by Sands Capital, with participation from Picus Capital, DN Capital, Coalition and BlackFin Capital Partners.

Hawk:AI, a German company developing anti-money laundering (AML) and tangential fraud prevention smarts for financial institutions, has raised $17 million in a Series B round of funding.

Nsknox

Nsknox, the global leader in Bank Account Validation and B2B Payment Security, announced today a new funding round of $17 million, bringing its total funding to date to $35.6M. Two new investors, U.S.-based Internet & technology venture capital firm Link Ventures and Harel Insurance & Finance, took a significant part in the round and were joined by existing nsKnox investors, including M12 – Microsoft’s Venture Fund, Viola Ventures, and Alon Cohen, the Company’s Founder and CEO and formerly Founder, Chairman and CEO of CyberArk.

Siren

Siren, the investigative intelligence company on a mission to keep people, assets and networks safe, today announced that it had received €12 million in funding from the European Investment Bank.

The announcement comes off the back of a record year for Siren. The firm reported 162% revenue growth, it achieved its first patent with four additional pending, established a brand new headquarters in the Galway Innovation District and was acknowledged in the Deloitte Technology Fast 50 as one of the fastest growing companies in Ireland.

DirectID

Credit risk assessment and decisioning platform DirectID has raised $9.5 million (€9 million) in funding from Ingka Investments, the investment arm of Ingka Group. The company will use the additional funding to help fuel the launch of its predictive credit and risk models built using open banking data. DirectID also plans to bring its credit risk solutions to new markets, as well as accelerate its development of models for each stage of the credit lifecycle – from originations to portfolio management to collections.

Salv

Tallinn-based Salv has raised €4 million in a seed extension round. Founded by former Wise and Skype employees, Salv uses the collective power of its network to minimise non-compliance and financial crime, essentially using the power of the hive to give the good guys a leg up.

Themis

Digital financial crime platform Themis has successfully overfunded in its latest Pre-Series A funding round, raising a total of £3.1m.

This comes on the back of a successful seed round of £1.67m in 2021. The company is currently valued at £15.4m and is forecasting a robust growth “as governments and regulators around the world crack down on AML failings and more and more companies recognise the importance of conducting comprehensive due diligence on their clients, suppliers and third parties.”

Geocomply

GeoComply Solutions, a Vancouver, Canada-based geolocation security provider, received a new investment from Norwest Venture Partners and Arctos Sports Partners.

The amount of the deal was not disclosed.

Acquisition

Seon

Budapest-based SEON — an anti-fraud platform which looks at a customer’s “digital footprint” to weed out false accounts and thus prevent fraudulent transactions — has acquired compliance and AML specialist firm, Complytron, also based out of Budapest.

Terms of the deal were not officially released, but TechCrunch sources said the deal was in the region of €2.5 million, although SEON declined to comment. Complytron had previously raised €410,000 from Budapest-based VC Hiventures.

ActiveFence

ActiveFence has completed the acquisition of Rewire, a London-based startup that’s building AI for online safety.

Combining ActiveFence’s Trust and Safety platform, content detection AI models and scalable API with Rewire’s repertoire of innovative text models will arm customers in the fight against malicious behavior, allowing them to reliably find and take action against dangers at scale in real time.

| Tagged with: |

| Posted in: | AF Education |