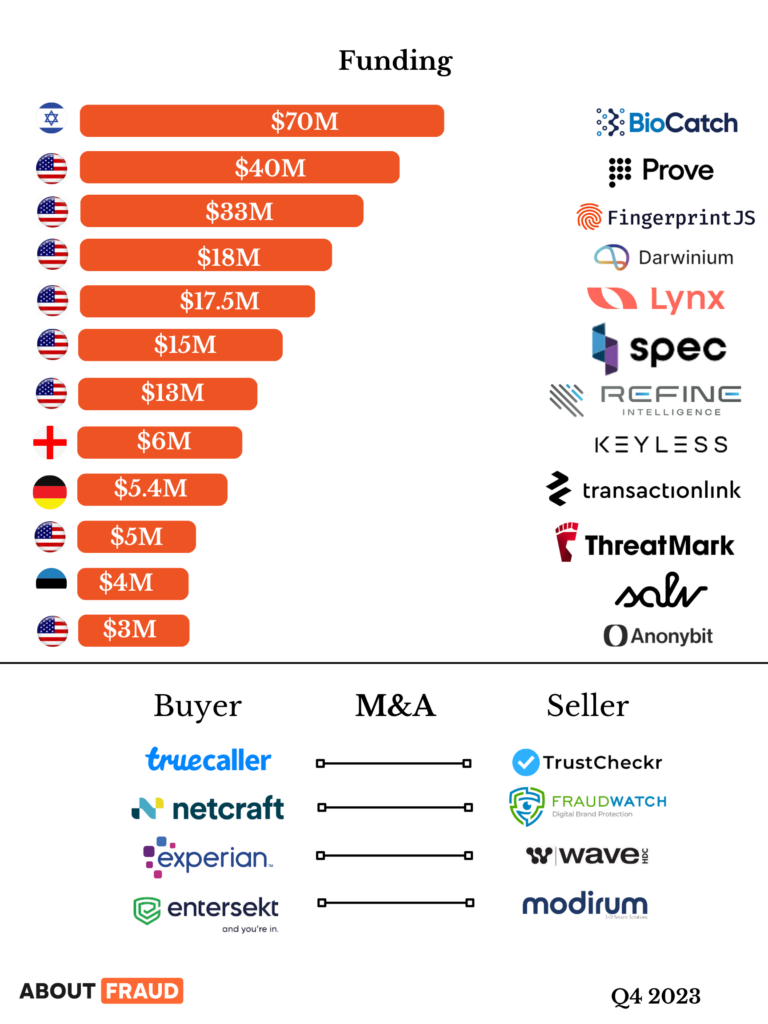

Investment, Acquisitions & IPOs – Q4 2023

Q4 is a wrap! It’s time for our quarterly investment update. Dive in to discover the latest funding and acquisitions in the fraud/risk space!

Funding

BioCatch, a leader in software development for bank fraud and money laundering prevention, achieved unicorn status amidst the Hamas-Israel conflict with a new secondary deal. The company secured $70 million from Sapphire Ventures at a valuation exceeding $1 billion, marking its second significant secondary transaction in 2023.

Prove Identity, formerly Payfone, the smartphone-based identity verification startup, has raised $40 million in funding at a ten-figure valuation, surpassing the $1 billion mark. With approximately 1,000 business customers, the company has seen a 40% growth in its international business over the last year and maintains positive cash flow.

Fingerprint has successfully raised $33 million in a Series C funding round led by Nexus Venture Partners, with participation from Uncorrelated Ventures. This funding will support the company’s growth, catering to larger Enterprise organizations and maintaining its industry-leading self-service product for engineers and small businesses.

Darwinium announced a $18 million Series A round led by U.S. venture partners to address the escalating challenge of fraud. The funding will further the company’s mission to combat fraud effectively by creating a more connected and efficient data model, overcoming the increasing costs and customer friction associated with current solutions.

Lynx

Lynx, specializing in AI for fraud detection and prevention, secured €17 million in a Series A funding round led by Forgepoint Capital. With participation from Banco Santander, Lynx aims to address the growing digital fraud landscape, providing solutions relevant to the financial sector facing substantial expenditures in financial crime compliance.

Spec

Spec, a fraud defense platform, announced the successful close of its $15 million Series A funding round. The platform, developed during the early days of the pandemic, invisibly protects enterprises processing billions in online transactions and actively counters AI-powered attack tools.

Refine Intelligence, with a transformative Financial Crime Greenflagging approach, secured $13 million in seed funding. Partnerships with Glilot Capital Partners, Fin Capital, SYN Ventures, Valley Ventures, and Ground Up Ventures will strengthen its position in reshaping Anti-Money Laundering processes.

Keyless

Keyless, a biometric authentication technology startup, raised $6 million in a funding round led by Rialto Ventures. The funding supports Keyless’ mission to unify the identity lifecycle with privacy-preserving biometric authentication.

TransactionLink

TransactionLink, a drag-and-drop builder for onboarding processes, raised €5 million in a seed round led by White Star Capital. The funds will facilitate the expansion of its KYB product into new sectors and the growth of its co-headquarters in Berlin and London.

ThreatMark, a behavior-based fraud prevention innovator, successfully completed a funding round, securing $5 million USD from Orbit Capital. This investment will advance research and development, expand market reach, and enhance ThreatMark’s cutting-edge fraud prevention solutions.

Salv

RegTech firm Salv secures an additional €3.9 million in funding for expanding its market presence. Currently employed by 53 financial institutions across 12 countries, Salv’s comprehensive tool suite has garnered €7.9 million in capital raised this year, reaching a total funding milestone of €12.1 million.

Anonybit

Anonybit, an innovator in decentralized biometric authentication, secured an additional $3 million funding round led by JAM FINTOP. The total funds raised now stand at $8 million, accelerating Anonybit’s mission to provide privacy-by-design identity management solutions to enterprises.

Acquisition

Truecaller

Truecaller, the global contact verification platform, has acquired Unoideo Technologies, an India-based company providing the TrustCheckr service. TrustCheckr is a SaaS platform dedicated to assisting businesses in verifying customer information and identifying fraud risks through phone numbers and digital signals.

Netcraft

Netcraft, a global leader in cybercrime detection, disruption, and takedowns, has acquired FraudWatch, a prominent Australian online brand protection provider. Specializing in phishing, social media threats, brand infringement, and fake mobile apps, FraudWatch, alongside Netcraft, aims to offer cutting-edge cybersecurity products and services globally. Netcraft’s innovations, including global threat feeds and automated attack detection, complement FraudWatch’s managed online brand protection services.

Experian has acquired Wave HDC, a healthcare technology leader specializing in AI-enhanced data curation solutions. Wave HDC’s expertise lies in identifying unknown insurance benefits coverage and critical patient demographics at the beginning of a patient’s healthcare journey. This acquisition enhances Experian Health’s business portfolio, providing more comprehensive and efficient healthcare coverage identification and automation capabilities.

Entersekt, The Financial Authentication Company, has acquired Modirum 3-D Secure software business from Modirum, a digital payment security provider with a 25-year history. Modirum’s cloud-based 3-D Secure (3DS) technologies authenticate digital payment transactions globally. Entersekt’s acquisition expands its customer base, securing over 2.5 billion transactions annually. This positions Entersekt with a compelling global footprint and a technological advantage across digital, payment, and data channels for issuers, acquirers, and merchants.

| Tagged with: |

| Posted in: | AF Education |