Investment, Acquisitions & IPO’s – Q1 2025

The first quarter is in the books, time for our investment roundup! Dive into the newest funding deals and acquisitions shaping the fraud and risk landscape.

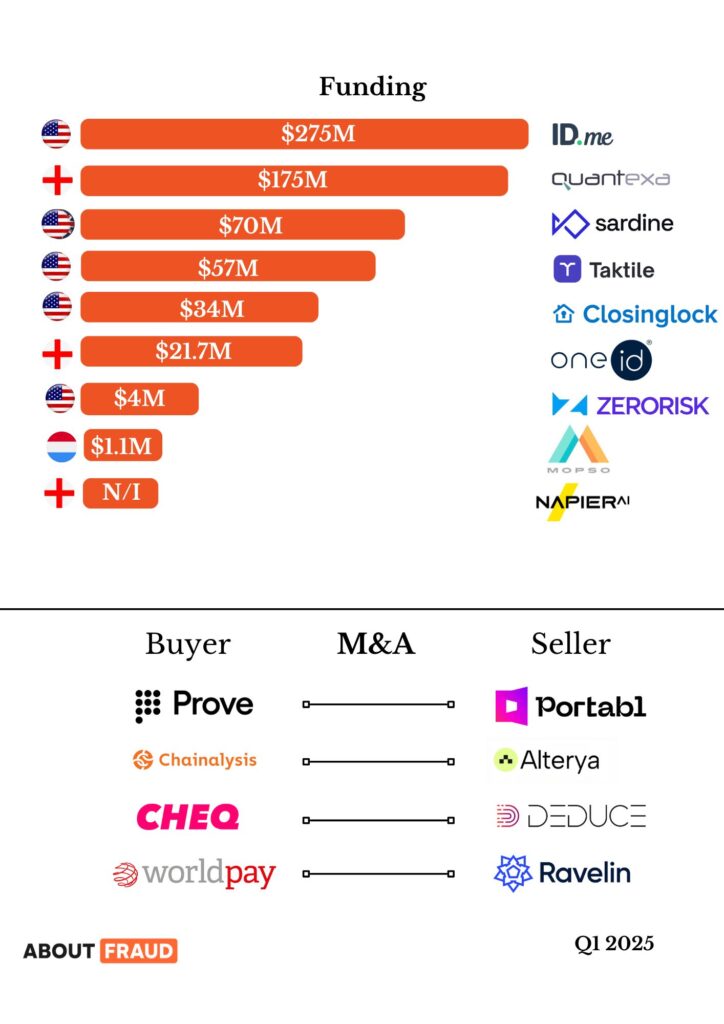

Funding

ID.Me

Digital identity‑wallet provider ID.me has landed a $275 million credit facility from Ares Management, and Ares plans to follow up with a sizeable equity stake.

The fresh capital will fuel ID.me’s next stage of growth as it scales its secure, privacy‑focused identity‑verification solutions.

Quantexa

Quantexa has closed a USD 175 million Series F round, lifting the company’s valuation to USD 2.6 billion. The financing was led by Teachers’ Venture Growth (TVG), the late‑stage venture arm of the CAD 255 billion Ontario Teachers’ Pension Plan. Proceeds will fund new product initiatives, accelerate platform innovation, and fuel Quantexa’s continued expansion across North America.

Sardine

Sardine, a risk‑management platform that helps enterprises combat fraud, meet compliance requirements, and underwrite credit, has secured $70 million in new funding. The capital will be used to develop AI‑powered agents designed to detect and prevent fraud at scale.

Taktile

Taktile, a risk‑decision platform built for the AI era, has closed a $54 million Series B financing led by Balderton Capital. Existing backers Index Ventures, Tiger Global, Y Combinator, Prosus Ventures, Visionaries Club and former U.S. Treasury Secretary Larry Summers also joined the round.

Founded in 2020 and now headquartered in New York, Taktile supplies decision‑automation infrastructure to some of the world’s most sophisticated financial institutions. The new capital will be used to accelerate product development and expand the company’s global footprint.

Closinglock

Closinglock, a leading provider of fintech and fraud prevention solutions for the real estate sector, announced today that it has secured $34 million in a Series B funding round. The round was led by Sageview Capital, with participation from Headline and RWT Horizons.

This new funding will support the company’s ongoing efforts to enhance the security and efficiency of U.S. real estate transactions by safeguarding the transfer of funds and information. To date, Closinglock has helped protect over 1 million home sales valued at more than $500 billion. Additionally, its Good Funds Payments tool has enabled the secure transfer of over $600 million in payments.

OneID

FinTech startup OneID, a provider of bank-verified digital identification services based in Stratford-upon-Avon, has raised over €19.1 million to support its growth and expand its operations and services to serve an increasing customer base.

The funding round was led by ACF Investors and included participation from over 200 angel investors from the UK, Sweden, and the U.S.

ZeroRisk

ZeroRisk, a leader in merchant risk and compliance management software, announced today that it has raised $4 million in a funding round led by Elkstone. The company plans to utilize the funds to expand its presence in the United States, where it currently works with several Tier 1 acquiring banks.

Founded in 2023 with the goal of redefining compliance and cybersecurity, ZeroRisk provides end-to-end merchant management solutions for top financial institutions worldwide. Its technology simplifies payment card industry compliance and offers real-time data insights for acquiring banks, payment service providers, digital merchants, and other financial organizations to effectively manage complex portfolios.

Mopso

Mopso, a RegTech startup based in Luxembourg, has successfully raised €1 million in seed funding to speed up its growth throughout Europe and to continue refining its innovative anti-money laundering (AML) solution.

This achievement marks an important step for the company, which recently moved its headquarters from Milan to Luxembourg and is now based at the Luxembourg House of Startups, setting the stage for further expansion in the regulatory technology sector.

Napier

Napier AI, a RegTech firm based in the UK, has announced that it has secured a significant growth investment from Marlin Equity Partners. This strategic funding will help the company bolster its position in the industry.

The new capital will be directed toward expanding research and development initiatives and supporting the company’s efforts to grow its presence on a global scale. Additionally, the investment underscores the rising demand for AI-powered solutions in combating money laundering and terrorist financing activities.

Acquisition

Prove

Prove, a leader in mobile identity verification and authentication, has now acquired Portabl, a digital identity firm specializing in reusable IDs and network verification. Supported by major investors like Harlem Capital and Bessemer Venture Partners, the acquisition enhances Prove’s mobile identity solutions with Portabl’s innovative approach to W3C standards like verifiable credentials.

Chainalysis

Chainalysis, a leader in blockchain analysis, has acquired Alterya, a startup specializing in AI-powered fraud detection.

Alterya collaborates with major crypto exchanges like Binance, Coinbase, and Block, as well as top financial institutions, to monitor over $8 billion in transactions monthly across crypto and fiat networks.

CHEQ

CHEQ has acquired Deduce to enhance its security platform with an identity graph for better detection of both human and AI-generated fraud. By combining AI-based threat detection with identity insights, the integrated solution aims to safeguard more attack vectors throughout the customer journey.

Worldpay

Worldpay has announced its agreement to acquire Ravelin Technology, a leader in AI-driven fraud prevention. This acquisition will strengthen our existing solutions, helping merchants of all sizes combat increasingly sophisticated fraud and grow securely.

| Posted in: | AF Education, Latest News |