Investment, Acquisitions & IPO’s – Q1 2024

The first quarter has concluded! Now, it’s time for our quarterly investment update. Delve into the latest funding rounds and acquisitions in the realm of fraud and risk mitigation!

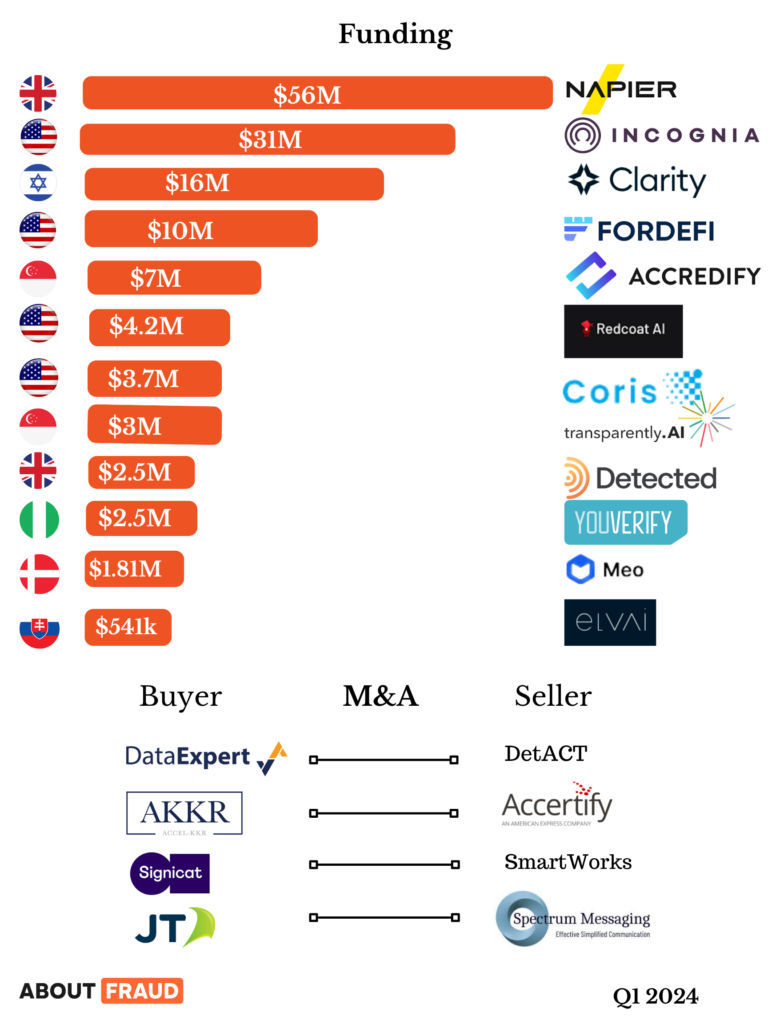

Funding

Napier

Napier AI, a UK-based RegTech company specializing in AI-driven financial crime and regulation technology compliance solutions, has secured a £45 million investment from Crestline Investors, a US-based firm.

Established in 2015 and headquartered in London, Napier AI offers advanced AML screening services tailored for the banking, payments, and wealth & asset management sectors. Its technology assists institutions in detecting and monitoring criminal or suspicious activities, while also facilitating regulatory reporting.

With a strong focus on growth, Napier AI has experienced a consistent annual revenue increase of over 30% since 2021. The company attributes this growth to strategic investments in its sales and marketing efforts, as well as continuous product development through dedicated research and development initiatives. Currently serving 150 clients globally, Napier AI continues to expand its presence in the market.

Incognia

Incognia has announced that they have closed a Series B funding round with an impressive $31 million investment. Bessemer Venture Partners, a leading venture firm renowned in the SaaS industry, led this milestone financing round. Additionally, FJ Labs joined forces with their existing investors – Point72 Ventures, Prosus Group, and Valor Capital Group.

This funding injection will drive the advancement of the state-of-the-art technology, supporting the worldwide growth to deliver groundbreaking solutions in vital industries such as consumer internet, financial services, and eCommerce.

Clarity

Clarity secures $16 million in funding to combat deepfakes through advanced detection technology.

Clarity empowers organizations to swiftly detect and safeguard against deepfakes and synthetic media generated by AI. We are thrilled to announce a major advancement in Clarity’s mission to protect the world from the dangers of deepfakes: our collaboration with Walden Catalyst and Bessemer Ventures Partners. This new investment will enable us to intensify our fundamental research initiatives and deliver top-tier solutions to the essential infrastructure within our communities.

Having already integrated with prominent media publishers, government entities, and various enterprises, Clarity is now prepared to broaden our range of services and solutions.

Fordefi

FORDEFI recently secured an additional $10 million in funding led by Electric Capital, with new contributions from Paxos and Alchemy. This funding round follows the success of FORDEFI’s Core Wallet, which has gained substantial market share and processed over $3 billion in on-chain transaction volume.

The company aims to enhance crypto security by expanding its Core Wallet offering to various platforms, facilitating safe access to DeFi.

Accredify

Intrigued by the potential of blockchain technology to revolutionize document verification, tech enthusiast Quah Zheng Wei transitioned from a career as a chartered accountant to self-taught coder. Quah’s background in accounting sparked his interest in blockchain’s real-time authentication capabilities, which he found fascinating as it could potentially replace traditional accounting tasks.

In 2019, Quah co-founded Accredify in Singapore, a company dedicated to securely verifying documents. Today, Accredify announced a successful $7 million Series A funding round, co-led by iGlobe Partners and SIG Venture Capital, with continued support from Pavilion Capital and Qualgro. The company has already processed 12 million verifications on 2 million documents and served 600 users.

Initially focusing on collaborating with educational institutions to combat fake degrees and certificates, Accredify has since diversified into other sectors such as corporate registries and healthcare for a broader range of verification use cases.

Readcoat

Redcoat AI, a cybersecurity company focused on combating AI-powered threats, emerged from stealth mode with $4.24 million in funding led by Pear VC. Supported by Leonis Capital, Sancus Ventures, Kyber Knight, and others, Redcoat AI’s expertise in AI and cybersecurity positions them as leaders in safeguarding organizations against digital threats in the generative AI era.

Coris

Recently, Coris successfully closed a $3.7 million fundraising round, co-led by Lux Capital and Exponent Founders Capital. Notable participants in this round included Y Combinator, Blank Ventures, Bill Clerico, and Immad Akhund. Alongside this funding announcement, Coris introduced CorShield, the world’s first SMB fraud model, and a new business verification product. Leveraging LLMs at scale, Coris is modernizing SMB risk infrastructure for major enterprises such as Mindbody and Stax Payments.

Transparent.ai

Singapore-based Transparently.ai has secured an investment from Franklin Templeton as part of its participation in the asset manager’s FinTech Incubator program. This investment coincides with the AI company’s successful pre-Series A funding round of US$3 million, focusing on detecting accounting fraud.

Specializing in combating financial crime, the collaboration with Franklin Templeton will empower Transparently.ai to enhance its AI-powered fraud detection software and solidify its position in the fraud detection technology sector.

Transparently.ai’s AI software is designed to identify financial irregularities and potential fraud within corporate financial statements. By providing a risk score ranging from 0 to 100, the software assesses the likelihood and extent of accounting manipulation. This tool offers asset managers, banks, auditors, and exchanges a valuable resource for due diligence, enabling them to uncover questionable accounting practices, fraudulent activities, and weak corporate governance.

Detected

Detected, a business onboarding company, has recently secured $2.5 million in its latest funding round, bringing its total funding to $8.5 million.

Specializing in addressing the needs of payment companies and marketplace operators, Detected focuses on expediting the onboarding process for new merchants and customers, recognizing its critical importance in the commercial realm.

Through its innovative business onboarding platform, Detected not only reduces costs but also enhances compliance measures and minimizes regulatory risks for its diverse range of clients.

Utilizing Detected’s no-code modules, customers have the freedom to design their customized business onboarding workflow. By leveraging Detected’s ecosystem of risk, fraud, and compliance resources, customers ensure thorough checks are conducted effectively and efficiently.

Youverify

Youverify, a Nigerian company specializing in identity verification and anti-money laundering solutions for banks and startups, has secured a $2.5 million investment from Elm, a provider of digital solutions in Saudi Arabia.

This investment from Elm also includes a strategic partnership to help Youverify enhance AML compliance, strengthen global risk intelligence, and expand into new markets.

Since 2022, Youverify has expanded its real-time business verification coverage to 145 jurisdictions across 48 countries. The platform now offers real-time individual verification services in 46 countries, including credit history and national identity number checks. Founder and CEO Gbenga Odegbami mentioned that Youverify has exceeded its goals set during its seed extension round in 2022, which aimed to expand coverage to 30 African countries.

MEO

Meo, a provider based in Copenhagen, Denmark, offering a comprehensive platform for risk assessment and continuous due diligence, has secured an additional €1.67 million in funding.

Scale Capital, EIFO Ventures, and Gilion, who provided a €1 million loan, participated in this funding round.

The investment will be utilized by the company to drive growth and expansion efforts across Europe.

Established in 2015 by CEO Christian Visti Larsen, Meo delivers an integrated platform for KYC (Know Your Customer) and KYB (Know Your Business) processes. The platform is seamlessly connected to financial databases, business registries, AML providers, and fraud prevention APIs. Meo’s system aids businesses in streamlining customer onboarding processes, reducing turnaround times, and facilitating integrated identity verification in a single platform.

Elv.ai

The internet safety startup Elv.ai unveiled a €500,000 investment, the Slovak startup merges AI with human moderators to enhance internet safety for discussions. It also safeguards the credibility of media and public bodies on their social platforms.

Initially established as a non-profit initiative by Slovak communications agency New School Communications in reaction to hybrid warfare and Russia’s 2022 invasion of Ukraine.

Responding to strong demand last year, the agency transformed the service into a distinct startup, elv.ai, to safeguard clients’ social channels from misinformation, hoaxes, fake profiles, and scams.

Due to the intricacies and contextual nuances of language, Elv.ai integrates AI with human moderators to supervise the AI and identify potential linguistic subtleties beyond technology’s grasp.

Acquisition

DataExpert

DataExpert has acquired Fox-IT’s DetACT business unit to strengthen its counter fraud services in Europe. This acquisition aims to enhance DataExpert’s portfolio of Cybercrime, Counter fraud, and Cyber security technology services. DetACT, part of NCC Group’s Fox-IT division, has been providing advanced preventive fraud detection to European financial services clients for over 14 years.

DataExpert, a managed service provider of cybercrime and cybersecurity solutions, is combining forces with DetACT to offer end-to-end counter-fraud services. This collaboration will empower financial institutions to prevent online banking fraud through a combination of technology and expertise. The joint team will provide services including intelligence gathering, fraud prevention, and forensic investigation, often collaborating with law enforcement agencies.

Accel-KKR

Accel-KKR, a private equity firm focused on technology, has announced today that it has finalized an agreement with American Express (NYSE: AXP) to acquire Accertify, a wholly owned subsidiary. Accertify specializes in providing solutions for fraud prevention, chargeback management, account protection, and payment gateway services. Its cutting-edge technologies play a crucial role in safeguarding numerous businesses and enhancing their operational efficiency. Among Accertify’s clientele are 40% of the Top 100 online retailers, major global airlines, prominent sports betting platforms, and more. This investment will empower Accertify to expedite its expansion and drive product innovation in the global fraud prevention market as an independent entity. The specific terms of the deal have not been disclosed.

A report by Fortune Business Insights reveals that the global market for fraud detection and prevention was valued at $36.9 billion in 2022, with projections indicating growth from $44.0 billion in 2023 to $182.7 billion by 2030, demonstrating a remarkable CAGR of 22.6% throughout the forecast period. This growth is fueled by the rise in global e-commerce and the consequent surge in expenditure by companies across various sectors on fraud solutions to protect consumers while reducing the overall cost of fraud. With the backing of Accel-KKR, Accertify is well-equipped to confront these challenges effectively and continue spearheading innovation in the battle against fraud.

Signicat

Global anti-fraud software provider Signicat has recently acquired SmartWorks, an Icelandic company specializing in e-signatures. This strategic move aims to enhance Signicat’s presence in the Nordic region and expand its digital identity services. By integrating SmartWorks’ e-signature capabilities, Signicat aims to strengthen its offerings in identity verification and protection for online accounts and business credentials.

In addition to its existing services, Signicat will now provide enhanced e-signature capabilities, further solidifying its position in authentications, identity proofing, validations, trust orchestration, and related services. Signicat serves a diverse range of customers in the financial sector, payments, insurance, mobility, and government agencies across 44 countries, including the Icelandic government.

Signzy

Signzy, a digital banking infrastructure provider, has acquired Difenz, a company specializing in fraud risk management solutions, in a cash and equity transaction valuing USD 5 million. This acquisition not only signifies Signzy’s strategic expansion but also marks an exit for existing investor 8i Ventures.

The official release highlights the takeover of 8i-funded Difenz by Signzy, solidifying its position as a leading RegTech (regulatory technology) firm in the country. Signzy is now positioned to deliver cutting-edge risk and compliance solutions to financial institutions on a larger scale. While the transaction involves a cash and equity deal, specific details were not disclosed in the release.

Jersey Telecom

JT Group has revealed its acquisition of Spectrum Message Services, a renowned company known for its MoneyGuard platform that effectively combats financial fraud. This strategic decision not only enriches JT Group’s Mobile Intelligence solutions but also solidifies its position as a significant player in the international battle against identity theft and financial fraud.

Jersey Telecom (JT Group) recently disclosed its purchase of Spectrum Message Services, an Australian company recognized for its pioneering MoneyGuard platform in the fight against financial fraud. This significant agreement underlines JT Group’s dedication to bolstering its Mobile Intelligence solutions and establishes the Channel Islands-based telecom giant as a prominent figure in the global effort to combat identity theft and financial fraud.

| Tagged with: |

| Posted in: | AF Education |