Investment, Acquisitions & IPOs – Q3 2022

Q3 is wrapping up in a couple days, so it’s time for our quarterly investment update. As you can see, there is a lot more white space here as investments and acquisitions slowed down in Q3. The global economic climate surely has impacted investments in the fraud/identity space. Have a read to learn more about the relevant moves in the industry!

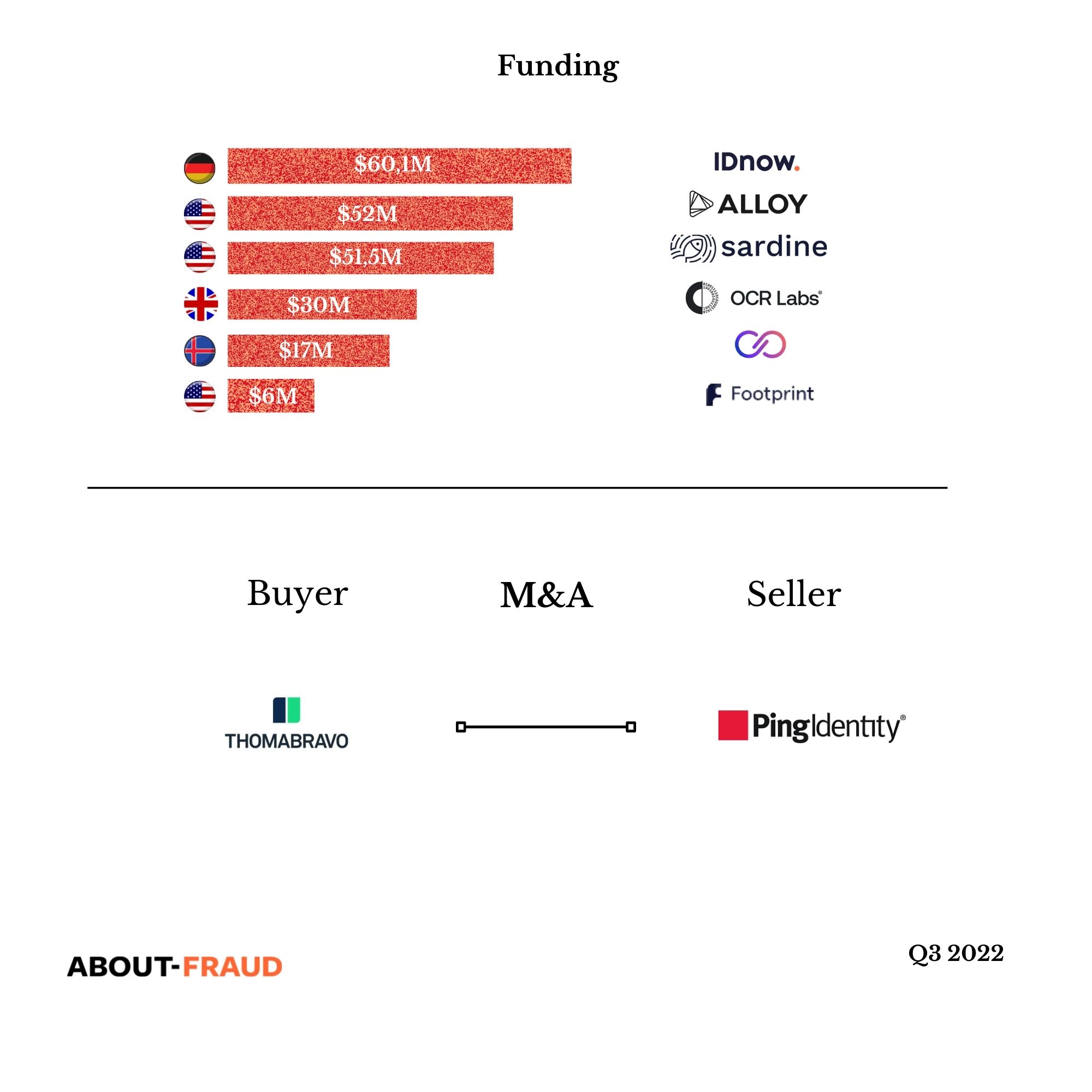

Funding

ID Now

Munich-based IDnow has secured access to €60 million (approximately US$60.1 million) in the form of a debt facility from asset management giant Blackrock to bring its digital identity platform and selfie biometrics to new markets.

The company says that the funds will be used to scale investments in strategic initiatives and introduce new identity proofing solutions. Geographical expansion and potential acquisitions are also noted as areas the money is earmarked for.

Alloy

Alloy announced that it raised an additional $52 million led by Lightspeed Venture Partners and Avenir Growth with participation from existing investors Canapi Ventures, Bessemer Venture Partners, Avid Ventures, and Felicis Ventures, bringing the company's valuation to $1.55 billion.

Alloy enables clients to pull in customer information, traditional credit bureau data, and other alternative data through a single point of integration, providing a complete picture of their customer. Earlier this month, the company announced its global expansion into 40 countries across North America, EMEA, LATAM, and APAC.

Sardine

Saridine, a platform focused on combating fraud via instantaneous crypto transactions has raised $51.5 million of venture funding, earmarked to aid the startup in rolling out new products more quickly.

Founded in 2020, Sardine supports application programming interfaces (APIs) for payments, fraud and compliance, as well as instant settlement for crypto and NFT transactions.

OCR Labs

OCR Labs has announced a $30 million Series B round led by New York-based Equable Capital to expand its team in North America and EMEA.

OCR Labs was originally founded in 2016 by Matthew Adams and Daniel Aiello and launched its first product in 2018 in London. Adams and Aiello wanted to streamline customer onboarding whilst protecting organizations against the increasing risk of fraud and identity theft.

Lucinity

Lucinity has announced the closing of a $17 million Series B investment round, led by Keen Venture Partners and joined by Experian and its major existing investors, Crowberry Capital, Karma Ventures, and byFounders.

By delivering user-centric compliance systems augmented by artificial intelligence (AI), Lucinity has helped various banks and FinTechs increase their compliance productivity by over 50%.

FootPrint

Footprint, a US based company that allows companies to securely onboard users, raised $6m in funding.

The round was led by Index Ventures, with participation from the founders of Plaid, Ramp, Lattice, Moonpay, Kayak, and Jumpcloud, as well as seed-focused funds BoxGroup, Operator Partners, Lerer Hippeau, Palm Tree Crew, Not Boring Capital, and K5.

Acquisition

Ping Identity

Thoma Bravo is buying Ping Identity for $2.4 billion, deepening a bet on the cybersecurity sector that has been one of the big winners of the pandemic.

Ping Identity will become a private company when the deal closes, which is expected in the fourth quarter of 2022.

| Tagged with: |

| Posted in: | AF Education, News |