Turning a “blind eye” on cybersecurity – understanding the risks of identity theft

No matter how many warnings people get, a huge percentage turn a blind eye to their cybersecurity. A lot of people don’t take precautions until it is too late.

If you look at the statistics on data breaches, and how easily you might fall foul of an account takeover either as a personal account or a business account, then you might take a different approach and keep yourself safe.

What is Identity Theft and How Does it Occur?

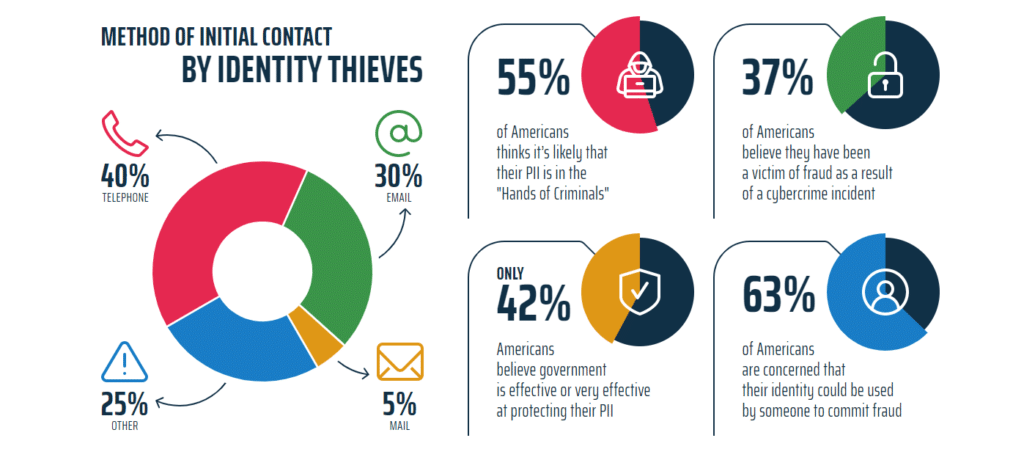

Identity theft is when somebody gains access to your personal information and pretends to be you. They might use this to make credit card applications or other lending, or sell the data to other people on the dark web.

In 2019, there were over 650,000 cases of identity theft in the US. This is quite a scary statistic. The financial implications can be huge, and some people never get the money back, so it is worth putting a system in place to stop identity theft.

What is Account Takeover?

This is one of the types of identity theft. An account takeover is where someone manages to get access to your user account. This might be on social media, where they can take your details, or it might be on your online baking, where they can take control over your money.

Account takeovers happen when passwords are exposed, which can be due to carelessness, but sometimes happens in data breaches, too.

What is Data Breaching – How is it Used in Fraud?

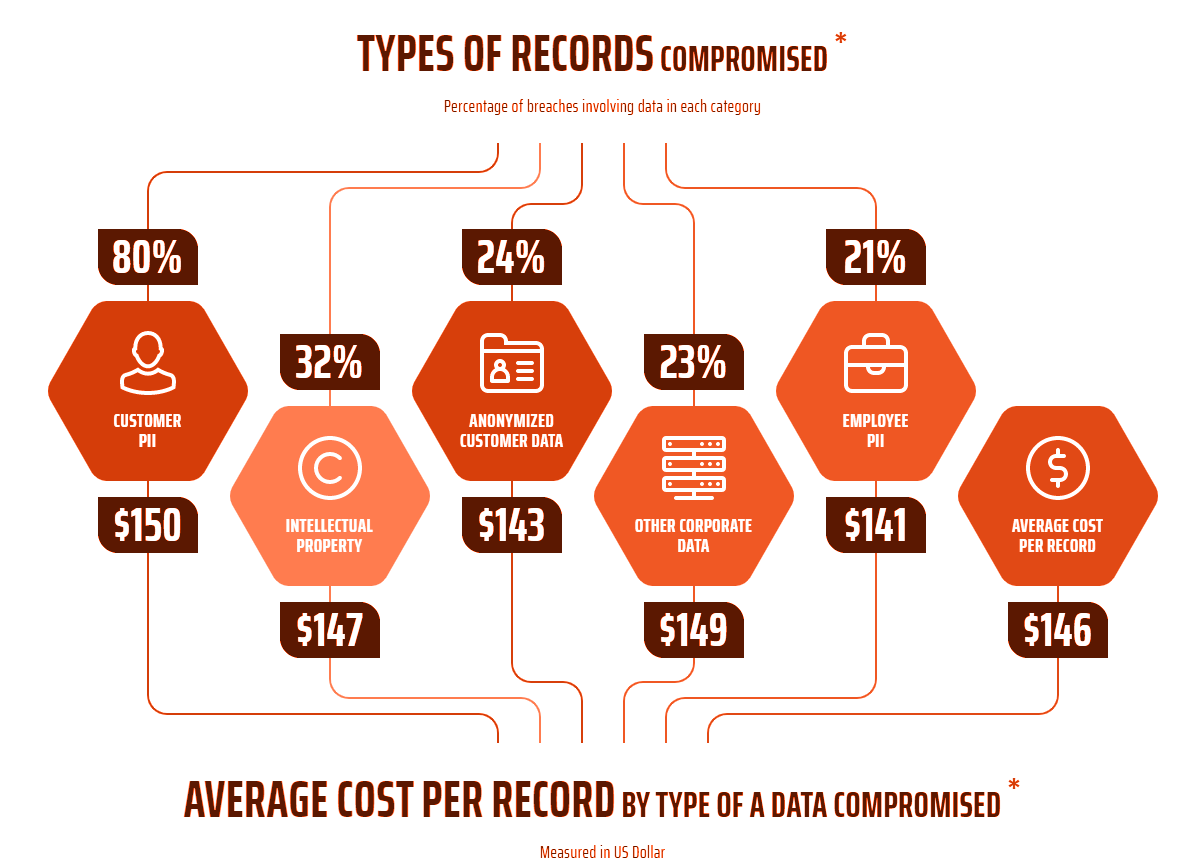

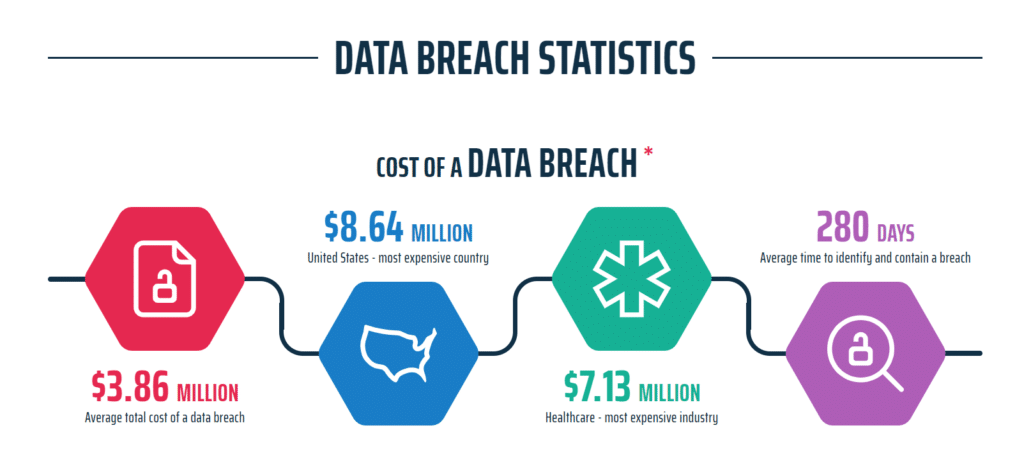

When a company loses the data of its customers, or discloses it without authorization, then it counts as a data breach. There are many ways in which companies can have their security compromised, and this can lead to hackers getting access to the data of thousands of customers.

There are some scary examples out there. Last year, the Texas Schools District lost over $2million to a phishing scam. Phishing is when someone sends an email with a fake link or malicious software. If you look in your “spam” folder you will see loads of these sorts of emails, but in a big company, only one has to get through to put everyone’s records at risk.

Data can be sold on the dark web for people to use on credit card and loan applications, among other illegal financial activities that are committed fraudulently under your name. Some hackers use ransomware, which demands payment in return for not leaking the data. This can cost a company hugely.

Keep Safe and Protect Yourself

There are some general tips you can use to protect yourself against financial fraud.

- Make sure you have good antivirus software to prevent someone from stealing your data via a virus.

2. Use strong, unique passwords for every single website you have an account with.

3. Sign up for a credit monitoring or account monitoring service to track when a credit application is made in your name.

4. Always check that you are buying items from trusted websites, and don’t leave your details anywhere they can be found by potential scammers.

5. Dispose of old hard-drives securely so that the data can’t be recovered.

6. Be very cautious about using any public Wi-Fi. Consider using a VPN for extra security.

Anyone can be fallible when it comes to identity theft. Criminals are becoming smarter about how they steal data, and there is always a new scam to be aware of. Recently, scammers have used coronavirus vaccines as their bait. Taking a few precautions can make it far less likely that you get caught out, and help to keep your financial future secure.

Source of all image is: www.IDStrong.com

| Tagged with: |

| Posted in: | AF Education, Interviews |